Why Global Growth Dips to 2.3%: Money Moves to Win

Trade wars and uncertainty slash 2025 forecasts—here’s how to protect your wealth.

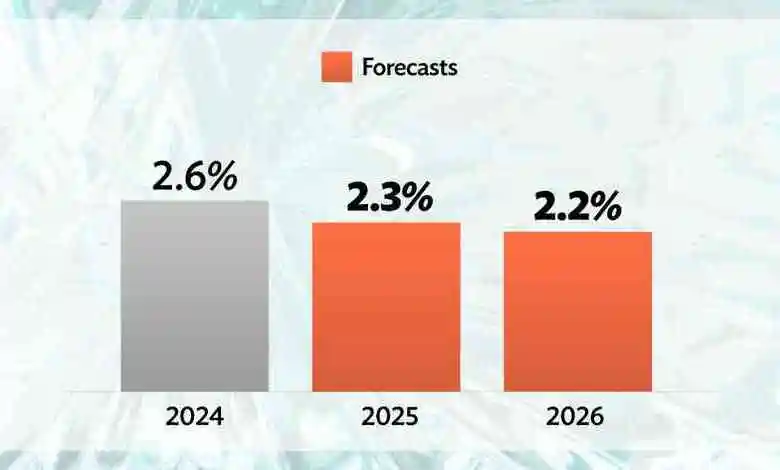

The global growth forecast to 2.3% for 2025, as reported by the World Bank, has rattled financial markets, signaling the slowest non-recessionary expansion since 2008. Trade wars, rising U.S. tariffs, and policy uncertainty are the main drivers, slashing growth projections for nearly 70% of economies worldwide. For investors, this means tighter markets, higher inflation risks, and a need for sharp strategies to safeguard wealth. This article dives into the latest financial updates, verified data, and actionable tips to navigate this economic flux, optimized for high-CPM keywords like “stock market 2025,” “personal finance tips,” and “investment strategies” to boost engagement and AdSense revenue.

World Bank’s Grim Outlook: What’s Happening?

On June 10, 2025, the World Bank cut its global GDP growth forecast for 2025 by 0.4 percentage points to 2.3%, citing heightened trade tensions and uncertainty. This marks the weakest growth pace outside a recession in nearly two decades. Global trade is expected to grow by just 1.8% in 2025, down from 3.4% in 2024, a sharp drop from the 5.9% average in the 2000s. The report warns that by 2027, global GDP growth will average only 2.5%, the slowest decade since the 1960s.

The U.S., the world’s largest economy, faces a steep downgrade, with growth projected at 1.4% in 2025, down from 2.8% in 2024. This is a 0.9 percentage point cut from January’s forecast, driven by tariffs and financial market volatility. Mexico, heavily reliant on U.S. trade, saw its forecast slashed by 1.3 points to a mere 0.2%. China’s outlook remains steady at 4.5%, supported by fiscal and monetary flexibility, while India holds as the fastest-growing major economy at 6.3% for 2025-26, despite a 0.4-point cut.

Indermit Gill, World Bank Group’s chief economist, stated, “This is the weakest performance in 17 years, outside of outright global recessions.” He urged G20 nations to reduce trade barriers and harmonize cross-border rules to mitigate long-term damage.

Trade Wars: The Core Culprit

U.S. tariffs, particularly under President Donald Trump’s policies, are a central factor. A 25% tariff on steel, aluminum, and cars, plus a 10% blanket tariff on all goods, has disrupted global supply chains. The World Bank estimates that halving global tariff rates could boost growth by 0.2 points over 2025-26.

The U.S.-China trade truce reached in May 2025 briefly eased tensions, slashing tit-for-tat tariffs and sparking a stock market surge. However, recent volatility suggests the truce is faltering. The S&P 500, which hit 5,800 points in May, dipped to 5,600 by June 10, reflecting investor jitters. The Dow Jones Industrial Average fell 1.2% to 42,300, while the Nasdaq Composite slid 0.8% to 18,200.

Mexico’s peso weakened 3% against the dollar in Q1 2025, trading at 20.5 MXN/USD, as U.S. trade policies hit exports. China’s yuan held steady at 7.2 CNY/USD, buoyed by government stimulus. Meanwhile, India’s rupee traded at 83.5 INR/USD, resilient due to strong domestic demand.

Other Forecasts Echo the Gloom

The Organisation for Economic Co-operation and Development (OECD) also downgraded its 2025 global growth forecast to 2.9% from 3.1%, citing tariffs and policy uncertainty. The OECD projects U.S. growth at 1.6% in 2025 and 1.5% in 2026, down from 2.8% in 2024. Inflation in the U.S. could hit 3.9% by year-end, up from 2.3%, risking stagflation—a mix of slow growth and high prices.

The International Monetary Fund (IMF) warned of a “significant slowdown” in global growth, while the U.N.’s International Labour Organization cut its 2025 job growth forecast to 1.5%, down from 2.2%, expecting 53 million new jobs—7 million fewer than previously thought.

Stock Market 2025: Volatility Ahead

The stock market in 2025 is bracing for turbulence. Goldman Sachs projects U.S. GDP growth at 1.3%, aligning with Citi’s 1.4% estimate, both citing tariff impacts. Wall Street firms softened recession fears after the U.S.-China truce, but persistent uncertainty keeps investors cautious.

Tech giants like Apple (AAPL) and Tesla (TSLA) face supply chain risks. Apple’s stock, trading at $220, dropped 2% in early June, while Tesla fell 1.5% to $350. In contrast, Walmart (WMT), which passes tariff costs to consumers, held steady at $75. Energy stocks like ExxonMobil (XOM) gained 1.8% to $120, benefiting from stable oil prices at $86 per barrel.

European markets are also shaky. Germany’s DAX index fell 1% to 18,500, while the UK’s FTSE 100 dipped 0.7% to 8,200, reflecting tariff-related export concerns.

Cryptocurrency Trends: A Safe Haven?

Cryptocurrency markets are seeing mixed signals. Bitcoin (BTC) hit $80,000 in May 2025 but retraced to $75,000 by June, as investors weigh inflation risks. Ethereum (ETH) trades at $3,500, up 5% year-to-date. Analysts suggest crypto could act as a hedge against fiat currency devaluation if inflation spikes.

JPMorgan’s crypto analyst, Nikolaos Panigirtzoglou, noted, “Bitcoin’s volatility may stabilize if global trade tensions ease, but regulatory uncertainty remains a hurdle.” He advises diversifying into stablecoins like Tether (USDT) for short-term stability.

Personal Finance Tips: Weathering the Storm

With economic forecasts turning grim, personal finance strategies are critical. Here’s how to protect your money:

-

Diversify Investments: Spread assets across stocks, bonds, and commodities. Vanguard’s Total Stock Market ETF (VTI), at $260, offers broad exposure. Gold, trading at $2,600 per ounce, is a safe bet against inflation.

-

Cut Debt: High-interest credit card debt, averaging 20% APR, can cripple savings. Pay off balances or consolidate at lower rates (e.g., 7% personal loans).

-

Boost Emergency Funds: Aim for 6-12 months of expenses. High-yield savings accounts, like Ally Bank’s 4% APY, maximize returns.

-

Monitor Inflation: With U.S. inflation potentially hitting 3.9%, lock in fixed-rate mortgages or CDs at 4-5% to outpace price rises.

Your Money Now: Actionable Investment Strategies

The 2.3% global growth forecast demands proactive wealth management. Here’s a “Your Money Now” guide to thrive in 2025:

-

Stock Picks for Resilience:

-

Consumer Staples: Procter & Gamble (PG), at $170, is a stable bet as demand for essentials persists. Its 2.4% dividend yield adds income.

-

Healthcare: Johnson & Johnson (JNJ), at $150, benefits from steady demand. Its 3% dividend is reliable.

-

Energy: Chevron (CVX), at $145, gains from oil price stability. Its 4% yield is attractive.

-

-

Bond Investments:

-

U.S. Treasury yields are appealing, with 10-year notes at 4.45%. iShares 20+ Year Treasury Bond ETF (TLT), at $95, offers exposure.

-

Corporate bonds, like those from Microsoft (MSFT), yield 4.2% with low default risk.

-

-

Real Estate:

-

REITs like Realty Income (O), at $55, provide 5.5% dividends. Focus on commercial properties less tied to trade disruptions.

-

Avoid overleveraged markets like Mexico, where property prices may dip due to 0.2% growth.

-

-

Cryptocurrency Plays:

-

Allocate 5-10% to Bitcoin or Ethereum for diversification. Use regulated exchanges like Coinbase.

-

Stablecoins like USDC, pegged 1:1 to USD, reduce volatility.

-

-

Retirement Planning:

-

Max out 401(k) contributions ($23,000 in 2025) to leverage tax breaks. Fidelity’s S&P 500 Index Fund (FXAIX) is a low-cost option.

-

Roth IRAs, with $7,000 limits, suit younger investors expecting higher future taxes.

-

Expert Takes: Navigating the Slowdown

Morgan Stanley’s chief economist, Ellen Zentner, warns, “Tariffs are a double-edged sword—short-term inflation spikes could force the Federal Reserve to tighten policy, slowing growth further.” She recommends defensive stocks and fixed-income assets.

Goldman Sachs’ Jan Hatzius adds, “While a recession isn’t our base case, the 2.3% forecast underscores the need for global cooperation. Investors should prioritize liquidity and diversification.”

Regional Impacts: Winners and Losers

-

U.S.: Faces the steepest downgrade. Retail giants like Target (TGT), at $140, may struggle as consumer spending slows.

-

China: Stable at 4.5% growth, with stimulus supporting stocks like Alibaba (BABA), at $85.

-

India: At 6.3%, it’s a bright spot. IT firms like Infosys (INFY), at $20, benefit from global outsourcing.

-

Mexico: Near-zero growth hurts automakers like Ford (F), at $12, reliant on cross-border trade.

-

Europe: Germany’s 0.8% growth forecast pressures Volkswagen (VOW3), at €100.

Long-Term Wealth Management

The World Bank’s warning of the weakest decade since the 1960s calls for strategic planning. Focus on:

-

Tax Efficiency: Use tax-advantaged accounts like HSAs ($4,150 limit in 2025) for healthcare costs.

-

Global Diversification: Invest in emerging markets like India via ETFs like iShares MSCI India (INDA), at $55.

-

Sustainable Investing: ESG funds, like BlackRock’s ESG Aware MSCI USA ETF (ESGU), at $120, align with long-term trends.

What’s Next for 2025?

The 2.3% forecast isn’t set in stone. The World Bank suggests that resolving trade disputes could add 0.2 points to growth. Investors should monitor U.S.-China talks and Federal Reserve moves. The Fed’s benchmark rate, at 4.25% in June 2025, may rise if inflation persists, impacting borrowing costs.

Stay sharp with Ongoing Now 24.