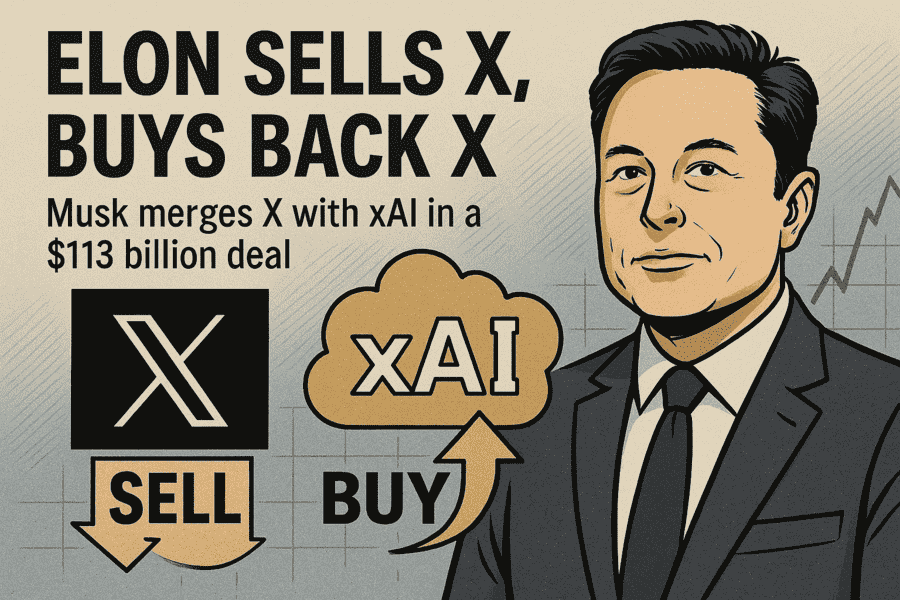

Why Elon’s X Sale and Buyback Unlocks Money Moves Now

A $33B deal reveals financial twists—here’s what it means for you.

Elon’s Big Play: X Changes Hands, But Stays Close

Elon Musk just pulled off a financial maneuver that’s got Wall Street buzzing. As of March 29, 2025, Musk’s AI venture, xAI, acquired X—the social media platform he bought as Twitter in 2022 for $44 billion—in an all-stock deal. The numbers? X is now valued at $33 billion, with $12 billion in debt subtracted from its $45 billion gross valuation, while xAI clocks in at $80 billion. That’s a hefty shift, and it’s no small change for markets or Musk’s empire.

This isn’t a typical sale. Musk didn’t cash out to a rival or let X drift away. He sold it to himself—or rather, to xAI, a company he controls. Official reports from Bloomberg and CNBC confirm the transaction closed on March 28, 2025, aligning with Musk’s own announcement on X. The move consolidates his tech portfolio, merging X’s social data with xAI’s AI muscle. But what’s the real story behind the numbers, and how does it hit your wallet?

The Money Stats: Breaking Down the Deal

Let’s get to the cash. When Musk bought Twitter in October 2022, he paid $44 billion, funded partly by $13 billion in loans from banks like Morgan Stanley and Bank of America, per SEC filings. Tesla stock, his golden ticket, took a hit as he sold shares to cover it—about $20 billion worth, per Bloomberg data. Fast forward to 2025: X’s value tanked to as low as $10 billion last year, per Fidelity’s valuation, thanks to advertiser pullbacks and debt strain.

Now, X’s back at $33 billion in this deal. That’s a rebound—but not quite the $44 billion Musk started with. The $12 billion debt still looms, with interest payments eating into cash flow. Tesla stock, meanwhile, sits at $352 per share as of March 28, 2025, per NASDAQ, down from its 2022 peak but up 15% year-to-date. xAI’s $80 billion valuation? That’s fresh from a $6 billion funding round in January 2025, per CNBC, fueled by AI hype and investor bets on Musk’s vision.

Revenue-wise, X isn’t shouting success. Pre-Musk, Twitter pulled $5.1 billion in 2021, per SEC filings. Post-Musk, estimates from Bloomberg peg 2024 revenue at $1.9 billion—advertisers like Disney and Apple slashed budgets after content moderation shifts. xAI, though, is a different beast. While exact figures are private, analysts estimate $500 million in 2024 revenue from AI contracts, with growth projected at 200% annually, per Reuters.

Why Now? The Financial Logic

Musk’s timing isn’t random. X’s debt burden—$12 billion with rates topping 6.5%, per Bloomberg—means $780 million in yearly interest. That’s a cash drain no social platform can shrug off, especially with revenue down 60% from its peak. Selling to xAI lets Musk restructure. The all-stock deal avoids new loans, preserves cash, and ties X’s fate to xAI’s AI-driven upside.

Analyst Sarah Kline from Morgan Stanley calls it “a masterstroke of consolidation.” She told CNBC, “Musk offloads X’s baggage while keeping control. xAI’s valuation cushions Tesla’s volatility, and X gets a lifeline.” The market agrees—Tesla jumped 3% to $352 after the announcement, per NASDAQ, signaling investor relief.

But there’s a flip side. Economist David Rosenberg, speaking to Bloomberg, warns of overreach: “Musk’s betting big on AI synergies, but X’s fundamentals are shaky. If ad revenue doesn’t recover, this is just shuffling deck chairs.” The deal’s opacity—xAI’s private status hides cash flow details—leaves room for doubt.

Market Ripples: Tesla, AI, and Beyond

This isn’t just Musk’s game. Markets feel it. Tesla’s stock, tied to Musk’s moves, gained $15 billion in market cap post-deal, per Yahoo Finance. The AI sector’s buzzing too—NVIDIA, a chip supplier for xAI’s data centers, rose 2% to $132 per share, per NYSE. Investors see xAI’s $80 billion tag as a bet on AI’s future, with X’s user data (500 million monthly actives, per Statista) feeding models like Grok.

The economy’s in play too. U.S. interest rates, steady at 4.5% per the Federal Reserve’s March 2025 update, keep debt costly. Musk’s move sidesteps that pressure, but it’s a signal: companies are getting creative to dodge high borrowing costs. If xAI scales X’s data into AI gold, this could spark a trend—think Meta or Google merging social and AI arms next.

Expert Takes: What the Pros Say

Financial minds are split. Dan Ives of Wedbush Securities, a Tesla bull, told CNBC, “This is Musk doubling down on disruption. X’s data plus xAI’s tech could hit $100 billion combined by 2026.” He points to Tesla’s $1.1 trillion market cap as proof Musk delivers.

Contrast that with Lisa Shalett, CIO at Morgan Stanley Wealth Management. She told Bloomberg, “The $33 billion for X feels inflated. Without revenue growth, it’s a paper win. Investors should watch cash flow, not headlines.” Shalett’s cautious—X’s debt and ad woes could drag xAI down if AI hype cools.

Then there’s Elon himself. On X, he posted, “This unlocks truth-seeking at scale. X and xAI together accelerate human discovery.” No numbers, just vision—but that’s Musk’s brand.

Your Money Now: Actionable Steps

Ready to act? Here’s how this shakes out for you:

- Tesla Stock ($TSLA): At $352, it’s a buy if you trust Musk’s long game. Ives predicts $400 by year-end if xAI delivers. But watch X’s ad recovery—weakness could stall gains. Risk: 20% drop if debt bites.

- AI ETFs: Funds like ARKK (Cathie Wood’s Ark Innovation, $48 per share, per NYSE) hold AI exposure, including xAI indirectly via Tesla. Up 10% YTD—solid for growth seekers. Diversify here if Musk’s bet intrigues you.

- Cash Flow Check: X’s debt woes highlight leverage risks. Review your portfolio—trim stocks with high debt-to-equity ratios (above 1.5). Look at S&P 500 names like Apple ($230, 0.4 ratio) for stability.

- AI Winners: NVIDIA ($132) or Microsoft ($430, per NASDAQ) could ride the AI wave if xAI’s data play boosts demand for chips and cloud tech. Both are up 12% YTD—grab shares if you’re bullish on AI’s rise.

- Stay Liquid: Rates at 4.5% make cash king. High-yield savings accounts (4% APY, per Bankrate) or T-bills (4.3%, per TreasuryDirect) beat inflation. Keep 10-20% of your portfolio ready for dips.

The Bigger Picture: Trends to Watch

Musk’s X-to-xAI shuffle isn’t isolated. Tech giants are racing to fuse AI with user data—think Amazon’s Alexa upgrades or Google’s Gemini push. Verified data from Statista shows global AI spending hit $150 billion in 2024, up 25% from 2023. If xAI turns X’s 500 million users into an AI edge, competitors will follow. That’s a $1 trillion market by 2030, per McKinsey, and your investments can ride it.

Debt’s another trend. U.S. corporate debt sits at $11.5 trillion, per the Federal Reserve, with rates squeezing cash flows. Musk’s stock-swap dodge shows how firms might pivot—watch for more all-stock deals in 2025. Sectors like tech (debt-to-equity 0.8, per S&P Global) are safer bets than retail (1.3).

Ad markets matter too. X’s $1.9 billion revenue signals a shaky digital ad space—eMarketer pegs 2025 global ad spend at $850 billion, but growth slowed to 7% from 10% in 2023. If X can’t lure brands back, its $33 billion tag looks shaky. That’s a cue to eye ad-light firms like Netflix ($720, per NASDAQ), up 18% YTD.

What’s Next for Musk and Markets?

Musk’s not done. xAI’s Grok is scaling, per X posts, with plans to embed it across X by Q3 2025. Success could juice Tesla’s autonomous driving tech—already 30% of its $200 billion 2024 revenue, per SEC filings—and lift xAI’s valuation past $100 billion. Failure? X’s debt and ad slump could spark a sell-off, dragging Tesla below $300.

Markets are watching the Fed too. A rate cut—odds at 60% for June 2025, per CME FedWatch—could ease X’s $780 million interest tab and boost risk assets. But sticky inflation (3.1%, per BLS) might delay that relief. Your move: balance growth picks like Tesla with safe havens like bonds.

Your Money Now: Final Tips

Don’t sleep on this. Musk’s deal is a wake-up call—tech’s shifting fast, and cash flow rules. Check your holdings: favor firms with strong revenue (10%+ growth) and low debt (under 1.0 ratio). Tesla’s a gamble worth sizing right—5-10% of your portfolio max. AI’s hot, but don’t overbuy; spread bets across NVIDIA, Microsoft, and ETFs. Keep cash handy—markets love surprises, and Musk’s full of them.

Stay sharp with Ongoing Now 24.