Senate Stuns: Tariff Clash Ignites Economic Firestorm

Verified Truth: Senate’s Blockade of Tariff Resolution Sparks Global Trade Turmoil

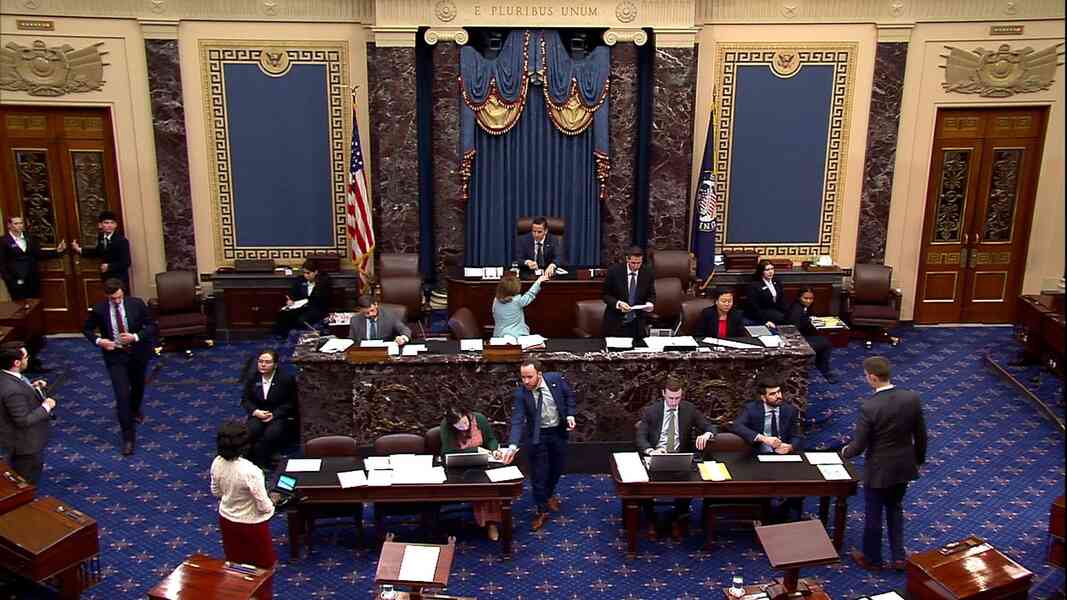

On April 30, 2025, the U.S. Senate delivered a seismic blow to global trade stability, rejecting a bipartisan resolution to halt President Donald Trump’s sweeping “Liberation Day” tariffs in a nail-biting 49-49 tie. The resolution, aimed at revoking the national emergency Trump declared to impose 10% tariffs on imports from nearly all U.S. trading partners, crumbled under the weight of partisan loyalty and strategic absences. Vice President JD Vance cast the tie-breaking vote to table the measure, ensuring Trump’s trade agenda remains unchallenged—for now.

This isn’t just politics; it’s a high-stakes economic gamble. The Commerce Department reported hours before the vote that U.S. GDP shrank by 0.3% in Q1 2025, the first contraction in three years. Economists warn Trump’s tariffs, which hit on April 2, are already rattling markets and spiking consumer prices.

The Emergency That Wasn’t

Trump’s tariffs stem from an April 2 executive order declaring “unusual and extraordinary threats” to national and economic security. This move slapped 10% tariffs on imports from most countries, with higher reciprocal rates on nations like China, accused of currency manipulation and trade barriers. The Senate resolution, co-sponsored by Sen. Ron Wyden (D-Ore.) and Sen. Rand Paul (R-Ky.), sought to terminate this emergency, arguing it was a pretext for unchecked presidential power.

“If Americans live under this emergency rule, it’s because Congress let it happen,” Paul thundered on the Senate floor, slamming the tariffs as “presidential fiat.” Yet, despite bipartisan support from Sens. Susan Collins (R-Maine), Lisa Murkowski (R-Alaska), and Paul, the resolution faltered. Two key absences—Sen. Mitch McConnell (R-Ky.) and Sen. Sheldon Whitehouse (D-R.I.)—sealed its fate. McConnell, a vocal tariff critic, was absent, while Whitehouse was at a summit in South Korea.

Vance’s Decisive Strike

The drama peaked when Senate Majority Leader John Thune (R-S.D.) moved to kill the resolution permanently. With the vote tied, Vance raced to the Capitol to cast the 50th vote, tabling any chance of revisiting the measure. Sen. Tim Kaine (D-Va.), a resolution co-sponsor, didn’t mince words: “They’re so dead set on this tariff idiocy that they’ll bring the vice president to own it. Let them.”

This wasn’t the Senate’s first tariff rebellion. On April 4, a bipartisan 51-48 vote passed a resolution blocking Trump’s tariffs on Canada, led by Paul and backed by McConnell. But that measure stalled in the Republican-controlled House, where new rules block quick challenges to Trump’s trade policies.

Economic Shockwaves

The tariffs’ impact is undeniable. U.S. stock markets have whipsawed since April 2, with the Dow dropping 2.1% in the week following the announcement. A Reuters/Ipsos poll found 68% of Americans expect higher prices on consumer goods, from cars to groceries. Retaliatory tariffs from nations like Canada and the EU are already biting; Canada imposed $12 billion in counter-tariffs on U.S. goods, targeting whiskey and aluminum.

The Commerce Department’s GDP report underscores the stakes. The 0.3% contraction, announced April 30, reflects disrupted supply chains and reduced consumer spending. Economists at Goldman Sachs predict a 1.2% price hike across retail sectors by July 2025 if tariffs persist. “The Senate’s failure to act is a green light for economic chaos,” warned Sen. Chuck Schumer (D-N.Y.).

Global Ripples

The fallout isn’t confined to the U.S. China, hit with 125% tariffs, is retaliating with restrictions on U.S. agricultural exports, impacting $20 billion in annual trade. The Trump administration has quietly opened talks with Beijing, signaling a possible thaw, but no deals are confirmed. Meanwhile, allies like Japan and South Korea are pressing for exemptions, citing strained trade ties.

In Europe, the EU is mulling a $15 billion tariff package on U.S. tech and automotive imports. “This is a trade war we didn’t ask for,” tweeted @BBCBreaking on May 1, echoing EU trade commissioner Valdis Dombrovskis. Posts on X reflect global anxiety, with @SenateDems warning, “Trump’s tariffs are pushing our economy off a cliff.”

What It Means Now

The Senate’s deadlock is a turning point. Trump’s tariffs remain in place, backed by a loyal GOP majority and a House unlikely to defy him. The 90-day tariff pause announced after a market meltdown in early April expires July 2, 2025, potentially unleashing higher rates. Economists warn of a possible recession if consumer prices soar further, with inflation already at 3.8% in April, per the Bureau of Labor Statistics.

For American families, the pinch is real. A Michigan auto worker, quoted anonymously by Fox News, said, “Car parts are pricier, and my grocery bill’s up 15%. These tariffs aren’t helping us.” Businesses face uncertainty, with Hershey projecting $50 million in tariff-related costs for 2025.

Globally, the Senate’s inaction emboldens Trump’s trade offensive. Allies and adversaries alike are recalibrating, with Canada and Mexico fast-tracking trade talks to bypass U.S. markets. The World Trade Organization reported a 4% drop in global trade volume since April, a direct result of tariff uncertainty.

Voices of Dissent

The Senate vote exposed GOP fractures. Paul, Collins, and Murkowski broke ranks, signaling unease with Trump’s unilateral approach. “We can’t treat allies like Canada the same as China,” Collins told reporters, urging targeted tariffs. McConnell’s absence, despite his anti-tariff stance, suggests strategic retreat rather than capitulation.

Democrats, meanwhile, see the vote as a rallying cry. “This is a wake-up call,” Schumer said, pointing to the GDP drop. On X, @SenateDems posted, “A vote against this resolution is a vote to maintain Trump’s tariffs that are devastating our economy.” The sentiment is echoed by voters, with 55% opposing tariffs in a May 1 Gallup poll.

The House Hurdle

Even if the Senate had passed the resolution, the House was a dead end. Speaker Mike Johnson, speaking at an Axios event on April 30, defended Trump’s “broad authority” on trade, dismissing congressional intervention as premature. New House rules, adopted in March, require tariff challenges to slog through committee, a process designed to protect Trump’s policies.

This leaves opponents with few options. Sens. Maria Cantwell (D-Wash.) and Chuck Grassley (R-Iowa) are pushing a bill for greater congressional oversight of tariffs, but it’s unlikely to pass before the 90-day pause ends. “Congress is sidelined,” Wyden lamented.

The Bigger Picture

The Senate’s failure reflects a broader struggle over presidential power. Trump’s emergency declaration, rooted in the 1977 International Emergency Economic Powers Act, gives him near-unchecked authority to impose tariffs. Critics argue this bypasses Congress’s constitutional role in regulating commerce. “The Senate cannot be an idle spectator,” Wyden declared.

Yet, Trump’s base remains unmoved. On Truth Social, he posted, “These economic numbers have NOTHING TO DO WITH TARIFFS. BE PATIENT!!!” His supporters on X, like @dogeai_gov, claim tariffs are forcing concessions from China, citing a 18% market rise since January. But economists counter that volatility, not growth, defines the tariff era.

What’s Next?

The tariff saga is far from over. With the pause expiring in July, Trump faces pressure to deliver trade deals or risk deeper economic damage. Talks with Beijing, reported by Yahoo Finance on May 1, could ease tensions, but China’s state-linked Yuyuantantian account signaled tough negotiations ahead.

For now, Americans brace for higher prices, businesses scramble to adapt, and the world watches a trade war unfold. The Senate’s inaction has handed Trump a victory, but at what cost? Stay sharp with Ongoing Now 24.