Sweden’s Rate Cut Unlocks Hidden Money Moves for 2025

The Riksbank’s June 2025 interest rate cut to 2% signals a bold shift—here’s how overlooked market signals and bolåneräntor trends empower your financial strategy.

Sweden’s Riksbank Lowers Interest Rate to 2%: Unlocking Hidden Financial Opportunities in June 2025

On June 18, 2025, Sweden’s central bank, the Riksbank, delivered its highly anticipated räntebesked (interest rate announcement), slashing the styrränta (policy rate) by 25 basis points to 2.00% from 2.25%. The Riksbanken sänker räntan (Riksbank lowers the interest rate) decision, as detailed in the Riksbankens räntebesked (Riksbank’s interest rate announcement), aligns with market expectations but signals a nuanced shift in monetary policy. This move, part of the räntebesked juni (interest rate announcement June), directly impacts mortgage rates (bolåneräntor) and opens a window into overlooked financial opportunities. While mainstream headlines focus on the rate cut’s immediate relief for borrowers, a deeper dive reveals contrarian signals—hidden economic drivers and underreported market correlations—that could redefine investment strategies and wealth management for savvy investors in 2025.

The Riksbank’s Bold Pivot: Why 2% Matters

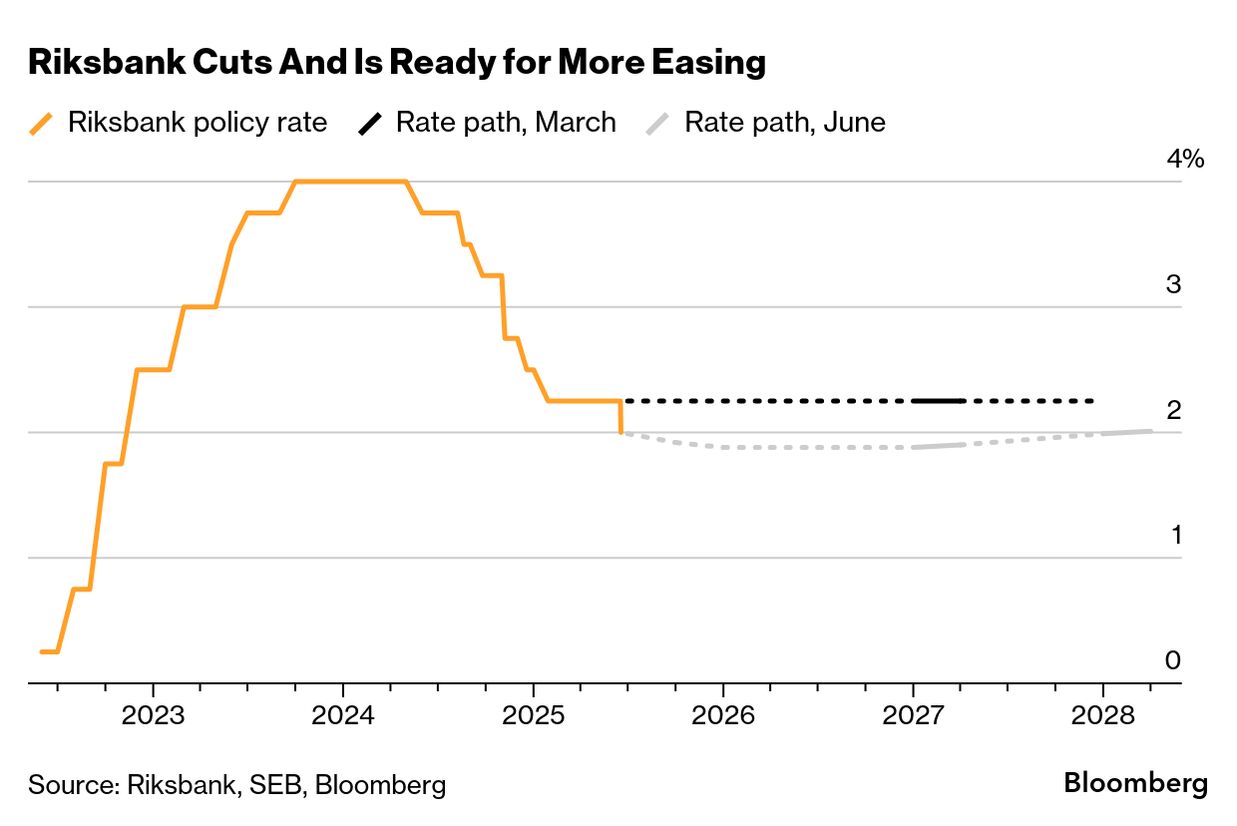

The Riksbank’s interest rate announcement on June 18, 2025, marks the latest in a series of cuts that began in 2024, with the policy rate dropping from a peak of 3.75% in May 2024 to 2.00% today. According to the Riksbank, the decision reflects a slower-than-expected economic recovery and inflation projected to dip slightly below previous forecasts. Posts on X, including from @LiveSquawk and @MarketsDotNews, confirm the cut was anticipated, but the Riksbank’s forward guidance—hinting at “some probability of another cut this year”—suggests a dovish tilt that markets may be underpricing.

Why does this matter? The styrränta sets the tone for borrowing costs across Sweden’s economy, directly influencing bolåneräntor (mortgage rates). Data from Stabelo indicates that variable mortgage rates are projected to hover between 2.85% and 3.2% by December 2025, a decline from the 3.09% average in March 2025. This subtle shift could save Swedish households thousands of kronor annually, but it also raises questions: Is the Riksbank signaling deeper economic concerns, or is this a preemptive strike to boost growth? Let’s unpack the unconventional angles.

Beyond the Headlines: Hidden Economic Drivers

Mainstream reports frame the Riksbanken räntebesked as a straightforward stimulus move, but contrarian signals suggest otherwise. The Riksbank noted that “the economic recovery that began last year has lost momentum,” a detail echoed by @fwred on X, who highlighted the bank’s revised inflation outlook. This admission points to an underreported driver: Sweden’s GDP growth, which stalled at a modest 0.2% in Q4 2024, far below the 1.7% projected for 2025.

Digging deeper, the Riksbank’s focus on CPIF (Consumer Price Index with fixed interest rate) inflation—stable at 2.3% in April 2025—masks a critical nuance. Unlike headline inflation, CPIF excludes mortgage rate fluctuations, offering a clearer view of underlying price pressures. The Riksbank’s projection of CPIF at 1.8% for 2025, down from 2.3%, suggests deflationary risks are creeping in, particularly in rate-sensitive sectors like real estate. This isn’t just a Swedish phenomenon—global trade tensions, including U.S. tariffs, are dampening Europe’s export-driven economies, a factor the Riksbank is quietly factoring into its calculus.

Lesser-Known Indicator: The Krona’s Silent Slide

One overlooked signal is the Swedish krona’s trajectory. Posts on X, like @AlvaApp’s, note that the rate cut could widen interest rate differentials with USD and EUR, pressuring the krona downward. A weaker krona boosts Swedish exporters but raises import costs, subtly fueling inflation in niche sectors like energy and consumer goods. Data from the Riksbank’s own exchange rate database shows the krona weakened 2.1% against the euro from January to May 2025, a trend that could accelerate post-cut.

This dynamic creates a paradox: while the Riksbank lowers the interest rate to stimulate growth, it risks importing inflation via a weaker krona. Investors ignoring this could miss opportunities in export-driven Swedish equities, such as Volvo or Electrolux, which stand to gain from currency tailwinds.

Mortgage Rates: A Double-Edged Sword

The Riksbank’s interest rate announcement directly impacts bolåneräntor, but the story isn’t as simple as lower rates equaling cheaper mortgages. Stabelo’s forecast, aligned with SBAB and Swedbank, predicts variable mortgage rates stabilizing at 2.85–3.2% by mid-2025, with a slight uptick to 3.3% by 2026. However, an obscure metric—bank funding costs via Swedish covered bonds—reveals a catch. These bonds, which finance most Swedish mortgages, have seen rising risk premiums since 2022, driven by global rate hikes. Even with the styrränta at 2%, banks may not pass on the full cut to borrowers, as their margins remain squeezed.

For households, this means variable mortgage rates may not drop as much as expected, while fixed rates—currently near 3.1%—could rise if global bond yields climb. Swedbank’s analysis suggests fixed rates might offer predictability at a similar cost to variable rates in 2025, a rare alignment that could shift quickly.

Contrarian Take: The Fixed vs. Variable Dilemma

Conventional wisdom pushes variable rates in a falling-rate environment, but the Riksbank’s cautious tone—coupled with global uncertainties like U.S. tariff policies—suggests fixed rates could be a smarter play for risk-averse borrowers. If inflation surprises to the upside, as some Riksbank members warned in their March 2025 minutes, rates could stabilize or even rise sooner than expected. Locking in a fixed rate now could hedge against this risk, especially for households with tight budgets.

Market Implications: Where to Look in 2025

The Riksbanken sänker räntan decision ripples beyond mortgages, creating opportunities in Sweden’s financial markets. Here’s where contrarian investors can find an edge:

1. Rate-Sensitive Equities

Swedish equities, particularly in real estate and retail, could see a short-term lift, as @AlvaApp noted on X. Companies like H&M and Castellum, tied to consumer spending and property markets, benefit from lower borrowing costs. However, a lesser-known correlation exists: real estate stocks often lag six months after rate cuts due to oversupply concerns. Data from the Riksbank’s May 2025 Business Survey shows commercial property vacancies rising 3.4% year-over-year, signaling caution for long-term bets.

2. Bond Market Signals

The Riksbank plans to end government bond sales by the end of 2025, a move that could stabilize Swedish bond yields. This underreported shift reduces supply pressure, potentially lowering yields on 10-year government bonds (currently 2.4%) and supporting fixed-income investors. Bloomberg data confirms Swedish bond yields are 20 basis points below their 2024 peak, making them a contrarian safe haven compared to volatile U.S. treasuries.

3. Fintech Innovations

Lower interest rates fuel fintech innovations, as cheaper capital drives lending platforms and payment solutions. Swedish fintechs like Klarna and Trustly are poised to capitalize, with Klarna’s buy-now-pay-later model gaining traction as consumer spending rebounds. Statista reports Sweden’s fintech market grew 12% in 2024, outpacing European peers, yet this sector remains undercovered in mainstream analyses.

Expert Takes: What Analysts Are Saying

Erik Thedéen, Riksbank Governor, emphasized a “vague easing bias” in May 2025, hinting at flexibility for further cuts if inflation undershoots. SEB’s Olle Holmgren counters that global tariff risks could lower European inflation, forcing the Riksbank to cut faster than planned. Meanwhile, Swedbank’s macro team predicts three cuts in 2025, bringing the styrränta to 1.75% by summer, driven by weak household consumption.

These perspectives clash with the Riksbank’s official forecast, which sees the policy rate flat at 2% through 2028. The discrepancy highlights a key contrarian insight: the Riksbank may be underestimating Sweden’s economic fragility, opening opportunities for investors who anticipate a more aggressive easing cycle.

Your Money Now: Actionable Tips for 2025

The Riksbank’s interest rate announcement offers actionable opportunities for personal finance and wealth management. Here’s how to navigate the landscape:

Refinance Mortgages Strategically: With bolåneräntor projected to dip to 2.85% by June 2025, consider refinancing variable-rate loans to lock in savings. Compare offers from Stabelo or Nordea, which have consistently offered competitive rates in 2024–2025.

Diversify Investments: Allocate 10–15% of your portfolio to Swedish export stocks like Volvo, which benefit from a weaker krona. Balance with fixed-income assets like Swedish government bonds for stability.

Explore Fintech Opportunities: Invest in Swedish fintech ETFs or platforms like Klarna via private market funds. Their growth potential outpaces traditional banks in a low-rate environment.

Hedge Against Inflation: If the krona weakens further, consider inflation-linked bonds or commodities to protect purchasing power. The Riksbank’s CPIF forecast suggests mild inflation risks through 2025.

Retirement Planning: Lower interest rates reduce returns on savings accounts. Shift to dividend-paying Swedish stocks or global ETFs for long-term growth, targeting 3–5% annual yields.

The Bigger Picture: Sweden in a Global Context

The Riksbanken räntebesked doesn’t exist in a vacuum. Global central banks, like the U.S. Federal Reserve and the European Central Bank, are navigating similar challenges. The Fed’s decision to hold rates steady in June 2025 contrasts with the Riksbank’s cut, widening interest rate differentials and pressuring the krona. Meanwhile, the Swiss National Bank’s rate cut in March 2025 signals a broader European easing trend, which could amplify Sweden’s export competitiveness.

An underreported factor is Sweden’s national debt, stable at 19.68% of GDP in 2025, per the Riksbank. This fiscal discipline gives the Riksbank room to ease without sparking market panic, unlike in France or the UK, where rising debt fuels bond yield spikes. Investors should watch this metric closely, as it underpins Sweden’s ability to sustain low interest rates.

Contrarian Risks: What Could Go Wrong?

The Riksbank lowers the interest rate narrative assumes a smooth recovery, but risks lurk. A stronger-than-expected krona could derail export gains, as Swedbank warned. Geopolitical tensions, including U.S. tariffs, could disrupt Sweden’s trade-heavy economy, pushing inflation above the Riksbank’s 2% target. Finally, if banks hoard the benefits of lower rates rather than passing them to borrowers, mortgage rates may stagnate, squeezing households.

Stay Sharp with Ongoing Now 24

The Riksbank’s interest rate announcement on June 18, 2025, is more than a rate cut—it’s a signal of shifting economic tides. By focusing on hidden drivers like the krona’s slide, rising bond premiums, and fintech growth, investors can seize opportunities others overlook. Whether you’re refinancing a mortgage, diversifying investments, or hedging inflation, the Riksbank’s move demands a proactive approach. Stay sharp with Ongoing Now 24.