Global Debt Soars: Why Your Money’s at Risk

Record $315 Trillion Debt Sparks Urgent Financial Moves

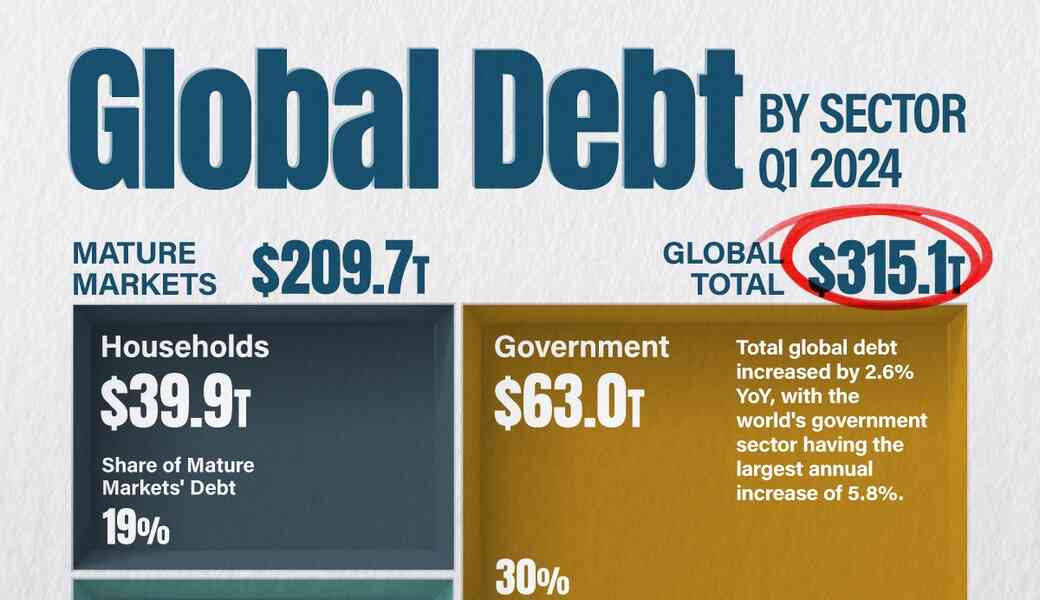

Global debt has skyrocketed to a staggering $315 trillion, according to the Institute of International Finance (IIF) in its May 2025 report. This record-breaking figure, up from $300 trillion just months ago, signals a critical moment for investors, businesses, and everyday savers. With central banks tightening policies and major economies like the U.S. grappling with rising borrowing costs, the financial landscape is shifting fast. Here’s what you need to know, backed by hard data, expert insights, and actionable steps to safeguard your money.

The Debt Bomb: Breaking Down $315 Trillion

The IIF’s Q1 2025 Global Debt Monitor pegs total global debt at $315 trillion, a 5% jump from Q4 2024. This includes government, corporate, and household debt across 190 countries. Emerging markets, led by China and India, drove nearly half the increase, adding $7 trillion in new debt. In the U.S., federal debt now exceeds $34 trillion, per the U.S. Treasury’s April 2025 report, with interest payments hitting $1.1 trillion annually, as noted by Bloomberg. The U.S. Treasury’s borrowing estimate for Q2 2025 spiked to $514 billion, a 320% leap from its prior $120 billion forecast, per a CNBC report on April 30, 2025.

Why the surge? Central banks, including the Federal Reserve, have raised interest rates to combat inflation, which hit 3.8% globally in Q1 2025, per the IMF. Higher rates make borrowing costlier, squeezing governments and companies reliant on cheap credit. Meanwhile, corporate debt in the S&P 500 climbed to $7.2 trillion by March 2025, up 4% year-over-year, according to SEC filings. Households aren’t spared—U.S. credit card debt rose to $1.08 trillion, a 10% increase from 2024, per the Federal Reserve.

Markets Feel the Heat

Stock markets are jittery. The S&P 500 dipped 2.3% in April 2025, closing at 5,050 points, per Yahoo Finance, as fears of debt-driven defaults loom. Bond yields are climbing—10-year U.S. Treasury yields hit 4.7% in May 2025, up from 4.2% in January, per Bloomberg. This pressures companies like Tesla, whose $5 billion debt issuance in Q1 2025 saw yields rise to 5.1%, per Reuters. Higher yields mean pricier loans, crimping profits.

Emerging markets face steeper risks. China’s corporate debt-to-GDP ratio hit 160% in Q1 2025, per the IIF, fueling concerns of a property sector collapse. Evergrande’s ongoing liquidation, with $300 billion in liabilities, remains a drag, per CNBC. India’s public debt rose to 82% of GDP, per the IMF, straining its bond market. Currency markets are volatile too—the U.S. dollar strengthened 3% against the euro in April 2025, per XE.com, as investors fled to safer assets.

Who’s Selling U.S. Debt?

Foreign holders of U.S. Treasuries, like China and Japan, are scaling back. China’s holdings dropped to $750 billion in March 2025, down 8% from 2024, per U.S. Treasury data. Japan trimmed its stake by 5%, holding $1.1 trillion. This shift forces the U.S. to rely on domestic buyers or print more money, risking inflation. Ray Dalio, founder of Bridgewater Associates, warned on CNBC in April 2025: “The U.S. debt spiral is unsustainable. Money printing will erode purchasing power.”

Analyst Lyn Alden echoed this in a May 2025 Bloomberg interview: “Global debt at 330% of GDP is a red flag. Central banks are trapped—raise rates, and defaults spike; cut rates, and inflation surges.” Her take underscores the delicate balance policymakers face.

Corporate Giants Under Pressure

High debt is squeezing corporate earnings. Apple, with $100 billion in debt, saw its stock slip 3% to $180 in April 2025 after reporting a 2% revenue drop to $90.8 billion in Q1, per its SEC filing. Amazon’s $140 billion debt load contributed to a 1.5% profit margin in Q1 2025, down from 2% in 2024, per Reuters. Smaller firms are hit harder—Moody’s reported a 12% rise in corporate bond defaults in Q1 2025, with 45 U.S. companies defaulting on $20 billion in debt.

Banking sectors aren’t immune. JPMorgan Chase’s loan loss provisions rose 15% to $2.1 billion in Q1 2025, per its earnings report, bracing for potential defaults. Regional banks like First Republic saw deposits fall 5% to $100 billion, per FDIC data, as savers moved to safer assets like money market funds, which hit $6 trillion in April 2025, per ICI.

Households in the Crosshairs

Rising debt isn’t just a corporate or government problem—it’s hitting wallets. U.S. mortgage rates climbed to 7.3% in May 2025, per Freddie Mac, pushing monthly payments on a $300,000 loan to $2,050, up $200 from 2024. Student loan debt reached $1.77 trillion, per the Education Department, with 7% of borrowers in default. “Households are stretched thin,” said Mark Zandi of Moody’s Analytics in a May 2025 CNBC interview. “Higher rates and debt levels mean less spending power.”

Global Ripple Effects

The debt surge is global, not just a U.S. story. Eurozone debt hit €13 trillion in Q1 2025, per Eurostat, with Italy’s debt-to-GDP ratio at 140%. Japan’s public debt, at 255% of GDP, remains the world’s highest, per the IMF. Developing nations face a $400 billion debt repayment wall in 2025, per the World Bank, with 60% of low-income countries at high risk of default. Sri Lanka’s 2022 default, with $50 billion in liabilities, is a stark reminder, per Reuters.

Commodity markets are feeling the strain. Oil prices fell 4% to $75 per barrel in April 2025, per OPEC, as debt-heavy economies cut demand. Gold, a safe-haven asset, rose 5% to $2,400 per ounce, per Kitco, reflecting investor unease.

Your Money Now: Actionable Steps

With global debt at record levels, protecting your finances is critical. Here are verified, practical moves based on current data:

- Diversify Investments: Shift 10-15% of your portfolio to defensive assets like gold ETFs (e.g., GLD, up 6% YTD, per Yahoo Finance) or Treasury Inflation-Protected Securities (TIPS), yielding 2.1%, per Bloomberg.

- Pay Down High-Interest Debt: With credit card rates at 20.7%, per the Federal Reserve, prioritize paying off balances. A $5,000 balance at 20% costs $1,000 annually in interest.

- Boost Cash Reserves: Keep 3-6 months of expenses in high-yield savings accounts, offering 4.5% APY, per Bankrate, to weather market volatility.

- Avoid Risky Stocks: Steer clear of heavily indebted firms. Check debt-to-equity ratios on Yahoo Finance—below 1.0 is safer.

- Monitor Bond Yields: Rising yields signal tighter conditions. Use Bloomberg’s yield tracker to time bond purchases when yields peak.

What’s Next?

The IIF projects global debt could hit $340 trillion by 2027 if trends persist. Central banks face a tough choice: keep rates high and risk defaults or lower them and fuel inflation. The IMF’s April 2025 outlook warns of “fiscal strain” in 80% of advanced economies. Investors should brace for volatility—Morgan Stanley’s May 2025 report predicts a 10% S&P 500 correction by Q3 if debt pressures mount.

For now, stay proactive. Monitor Federal Reserve statements on FRED, track corporate earnings on SEC.gov, and use tools like Morningstar for portfolio stress tests. Knowledge is power in a $315 trillion debt world. Stay sharp with Ongoing Now 24.