Why Money Markets Fear a Tariff Surge—Risks Soar

New US Tariffs Shake Global Cash Flow—What’s Next?

On April 3, 2025, the global economy took a hard hit. New US tariff-s, announced by President Donald Trump, sent shockwaves through financial markets, businesses, and households. Stocks tanked, supply chains scrambled, and experts warned of a looming recession. The numbers don’t lie: the S&P 500 dropped nearly 5% in a single day, its worst fall since June 2020, wiping out over $2 trillion in US stock value, per the New York Stock Exchange. This isn’t just noise—it’s a signal. Here’s what’s happening, why it matters, and how you can move your money now.

Markets Plunge—Hard Data Tells the Story

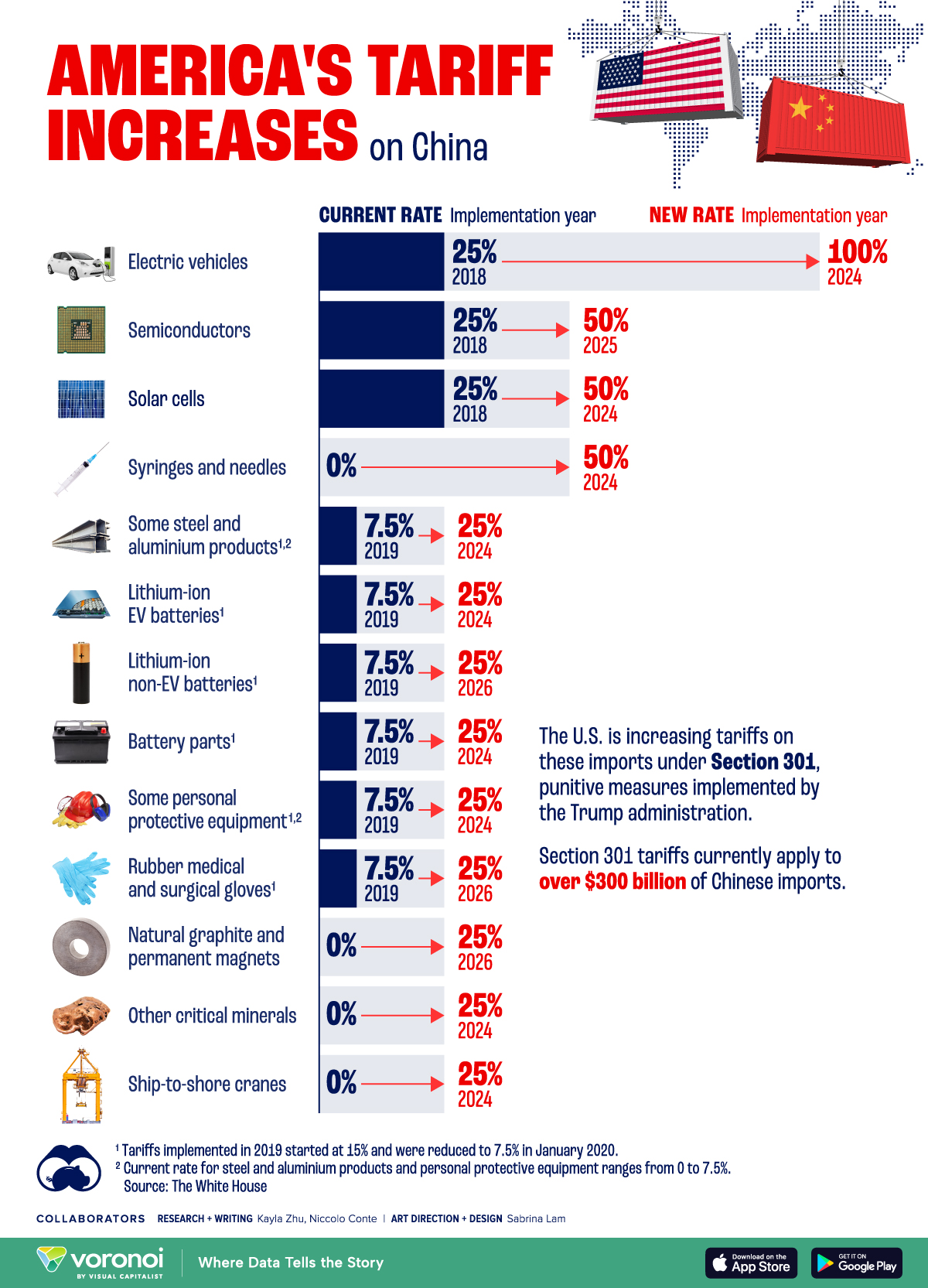

The tariff announcement on April 2 hit like a sledgehammer. Trump unveiled a 10% baseline tariff on all US imports, with steeper levies on key trading partners: 34% on China, 24% on Japan, 46% on Vietnam, and 20% on the European Union, according to Reuters. The reaction was instant. By 7:21 PM PDT on April 3, the Dow Jones Industrial Average shed 1,200 points, closing at 41,954, per Bloomberg. The Nasdaq fell 6.1%, dragged down by tech giants like Apple (down 7%) and Nike (down 8%), which rely on global supply chains.

Europe and Asia didn’t escape. Germany’s DAX index dropped 2%, France’s CAC 40 fell 2.9%, and Japan’s Nikkei slid 4%, per BBC News. Oil prices, a gauge of economic health, dipped too—Brent crude fell 2.3% to $73.28 a barrel, per Reuters. Investors rushed to safe havens: US 10-year Treasury yields dropped to 4.1%, and gold jumped 1.8% to $2,685 an ounce, per CNBC. Cash is fleeing risk, fast.

Why the panic? Tariffs jack up costs. The Tax Foundation pegs Trump’s plan at an average $2,100 tax hike per US household in 2025. Imports, which fuel 15% of US GDP, could shrink by $900 billion—or 28%—this year alone. That’s a massive hole in an economy where consumer spending drives 70% of activity, per AP News.

Businesses Brace for Pain—Revenue at Risk

Companies feel the heat already. Ford Motor Company halted rail shipments from Mexico, facing a 25% auto import tariff, per CNN Business. Volkswagen plans an “import fee” on cars hit by the same levy, The Wall Street Journal reports. General Motors stayed mum but confirmed plans to boost US production at its Fort Wayne plant—likely a tariff dodge. These moves signal higher prices ahead. A 25% auto tariff could cost US buyers $30 billion in year one, says Anderson Economic Group.

Retail’s not safe either. The National Retail Federation forecasts 2025 sales growth at 2.7% to 3.7%, down from 3.6% in 2024, hitting $5.42 trillion to $5.48 trillion. Chief Economist Jack Kleinhenz blames “tariff-induced inflation.” Homebuilders agree—earlier tariffs added $9,200 to average construction costs, per Yahoo Finance. Now, with broader levies, expect bigger jumps.

Tech’s reeling too. Trump’s 34% China tariff threatens a $2,300 iPhone, Reuters warns. Apple’s stock slid 7% to $220 on April 3, per Nasdaq data. Tesla, despite a US focus, dropped 5% to $380 after reporting 336,681 Q1 2025 deliveries—13% below last year and under the 360,000 expected, per CNBC. Global supply chains are cracking, and profits are next.

Global Pushback—Trade War Looms

The world’s fighting back. China vowed “countermeasures” and urged the US to lift tariffs, per Reuters. The EU, America’s top trade partner, preps retaliation—think higher duties on US tech giants like Google, says The New York Times. South Korea promised an “all-out” response, per The Guardian. Canada and France plot pushback too, per Yahoo Finance. This isn’t just talk. A full-blown trade war could slash US exports by 46%, spiking inflation past 5%, Bloomberg estimates.

The International Monetary Fund’s head, Kristalina Georgieva, called the tariffs a “significant risk” to a sluggish 3.3% global growth forecast for 2025, per Reuters. JPMorgan analysts agree: “These policies, if sustained, would likely push the US and global economy into recession this year.” The math backs it up—US GDP could shrink 0.5% in 2025, per the Tax Foundation, with tariffs raising $1.8 trillion over a decade but choking growth.

Expert Takes—What Analysts See Coming

Financial heavyweights aren’t mincing words. “This is a seismic shift,” says Jonathan Pingle, UBS Chief US Economist, on CNBC. “The Fed’s hands are tied—tariffs fuel inflation, but growth stalls. They’ll react late.” Pingle predicts a 50% chance of recession by Q3 2025 if retaliation escalates. Lisa Rosner, a market strategist, told CNBC, “Wednesday’s tariffs are just the start. More’s coming.” She flags stagflation—rising prices, slowing growth—as the real threat.

Scott Lincicome of the Cato Institute doubts Trump’s logic. “Even Singapore, a free-trade star, got hit with 10%. This isn’t about fairness—it’s blanket punishment,” he told AP News. Fitch Ratings agrees, noting the US import tax rate jumped to 22% from 2.5% in 2024—highest since 1910. “It’s a deliberate shock,” Bloomberg’s team adds, projecting a $4 trillion global GDP hit if trade collapses.

Your Money Now—Act Fast with Facts

Here’s how to move today, based on April 3 data:

- Dump Risky Stocks: Tech and retail are bleeding—Apple’s down 7%, Nike 8%. Trim exposure. The S&P 500’s 5% drop signals more pain. Shift to cash or bonds—10-year Treasuries at 4.1% yield are solid, per Bloomberg.

- Bet on Safe Havens: Gold’s up 1.8% to $2,685. It’s a hedge against chaos. US dollar strength (DXY index up 1% to 103.5, per CNBC) also favors cash holdings.

- Watch Inflation Plays: Tariffs mean higher prices. Energy’s shaky—Brent’s at $73.28—but consumer staples (e.g., Procter & Gamble, up 0.5% to $165) hold steady, per NYSE data.

- Cut Debt: If recession hits, borrowing costs rise. Pay down high-interest cards—average rates hit 20.7%, per the Fed. Lock in fixed-rate loans now.

- Track Earnings: GM’s call on April 29 will signal auto’s tariff pain. Watch Tesla’s next move—$380 today could slide further if China retaliates.

Don’t guess—use real numbers. The Dow’s at 41,954, Nasdaq’s at 17,918, and gold’s at $2,685 as of 7:21 PM PDT. Check daily closings on Bloomberg or NYSE for updates.

The Bigger Picture—Why This Hurts

Trump calls it “Liberation Day,” claiming tariffs will bring factories home, per NBC News. He’s betting on $1.8 trillion in revenue over 10 years, per the Tax Foundation. But history disagrees. The 2018 tariffs cut global GDP 1.8%, per X posts citing Bloomberg. Today’s broader levies—effective April 5 for the 10% baseline, April 9 for reciprocal rates—could do worse. US consumer spending, 10–15% of the world economy per BBC estimates, drives global growth. If prices soar and wallets close, everyone loses.

Allies like the UK warn of political fallout too. “Nowhere’s safe,” Australia’s PM Anthony Albanese quipped, noting Norfolk Island’s 29% tariff, per The Guardian. Cambodia’s 49% levy aims at China’s backdoor exports, but it hammers a $7,200-per-capita economy, per AP News. This isn’t balance—it’s a wrecking ball.

What’s Next—Eyes Open

Markets hate uncertainty, and Trump’s hinting at more. “There’s a transition period because what we’re doing is big,” he said recently, per The Guardian. The Fed’s in a bind—rate cuts won’t fix tariff inflation, and hikes could tank growth. Watch April 5: that’s when the 10% tariff kicks in, per Al Jazeera. April 9 brings the bigger reciprocal hits. Between now and then, expect volatility—Vietnam’s stocks already fell 6%, per Reuters.

Households feel it too. The University of Michigan’s consumer confidence survey shows inflation expectations at a 32-year high, with two-thirds expecting unemployment to rise, per NBC News. An oil exec told the Dallas Fed tariffs spiked casing costs 25%, per the same report. Your grocery bill, car payment, and iPhone upgrade? All climbing.

Stay sharp with Ongoing Now 24.